An options contract would be a two-party commitment developed to enhance a potential purchase. This sort of contract gives either buyer or seller the option to buy any asset class, including a corporation, at a predetermined price. The contract price is what it's termed. Up until about the contract's termination date, the transfer could happen.

Working of Option Contracts in Business

The following terms are included in the binary options contract:

- The contract's deadline has passed.

- The contract price, or the value whereby an essential item can be traded, is a term used to describe the valuation whereby a principal amount can be changed.

- The commodity at its core

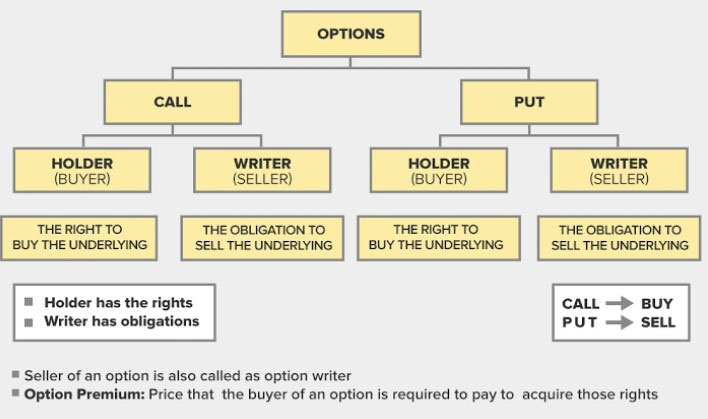

Call options are typically purchased as a total wager on developing a commodity or benchmark. Options contracts, on either hand, are typically purchased to benefit when prices come down. Buyers of options contracts have the opportunity, but just not the obligation, to purchase the percentage of investors specified in the contract somewhere at a discount rate. Put buyers get the option, but not the requirement, to sell their property just at the target recommended price under the agreement.

Buying Contacts (Long Calls)

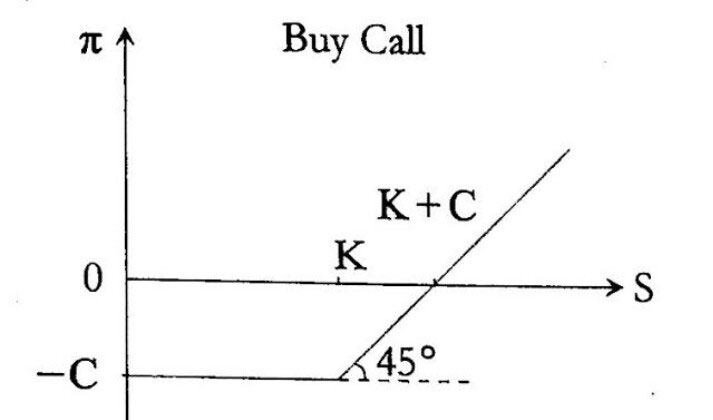

For investors wanting to make a directed bet inside the economy, options contractshave several benefits. You may buy a covered call with much less money than the property itself because you believe the increase in inflation will climb. If the value somehow drops instead, then losses are restricted to a charge you received again for pure and simple options. This can be the primary approach for buyers who are "overly optimistic" or enthusiastic around an individual stock, marketplace product, or investment account and still want to keep things on track.

Would you like to gain profit fromgrowing rates?

Options represent leveraged transactions because they enable buyers to increase the possible potential reward by employing fewer quantities than is necessary if buying the asset class directly. So, rather than spending $10,000 to acquire the shareholding of a $99 asset, you could invest $2,000 on options contractswith a market price of 10percentage points greater than the global pricing.

Loss/Gain

A protracted call's possible loss is confined to the insurance premium by the buyer. Since this option contract increases in lockstep only with the value of the underlying security through termination, there is potentially no limitation over how high things have gone.

Purchasing Puts (Long Puts)

A put option offers the buyerthe ability to sell the fundamental at a par value before a contract is up. In contrast, an option contract allows the investor to acquire the underlying at a specified rate than before the contract is up. This is the strategy of choice for investors who are adverse on a specific company, Investment, or market but don't want to take the loss.

Option Contracts inConstituent of a Work

As a component of their compensation package, numerous enterprises, particularly startups and local firms, provide option contracts. Employee share ownership agreements contain consumers buying shares in the corporation at a discounted price. Both the company and the employees gain from this relationship. Both the corporation and the employees expect that the stock value will now grow, which motivates the staff to achieve this goal.

The standard cost of Buying Option contracts

Typically, an option contract covers 100 units of the financial instrument. With each warranty, every buyer is responsible fora subscription cost. Even when an option means the cost of each contract is 35 dollars, purchasing one option charges $35. As there is more opportunity to accomplish again, buyers are ready to spend money for such an option that has elapsed time before execution. The larger the excess, the greater the level remains for the agreement to become viable but has inherent worth because buyers could purchase extra hours.

Why do businesses prefer option contracts over other contracts?

- A premium is paid to the vendor.

- The purchaser, like an options contract, receives a purchase. Irrespective of the outcome of the said contract, they can get paid.

- The value is derived from the different writers by option contracts.

If an entrepreneur understands using options contracts properly, they will have more expertise in adjusting their strategy and will be able to control danger while maximizing gains fully.