Automated trading systems give traders the ability to specify rules for trade exits and trade entries that, once programmed, can be carried out by computers. These trading systems go by a number of different names. Investors and traders can turn precise exit, entry, and money management guidelines in automated trade systems, which enable computers to manage and execute the trades. One of the most appealing aspects of automation strategies is that it will take some of the emotions from trading, as trades are placed automatically when certain requirements are met.

Automated trading systems generally require software linked to an access broker directly, and all rules are written in that software's language that is proprietary to the platform. For instance, the TradeStation platform, as an instance utilizes the programming language EasyLanguage. However, the NinjaTrader platform uses NinjaScript.

Advantages

Eliminates Trading Based on External Factors

Algorithmic software typically requires every trade to be programmed. This means traders will stay clear of impulsive or unthought-of trading and buying based on negative news about companies or economics or fear of missing out (FOMO) on a lucrative asset. Algorithmic trading also helps avoid errors in transactions with a quick finger, such as missing a zero on the price of a sell order.

Provides Opportunities for Backtesting

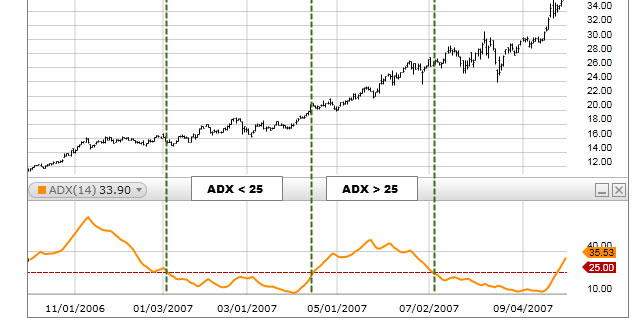

In trading backtesting, investors look back to historical data for clues on how they should invest their money in the near future. This strategy could use data from the past to see if a specific trading plan can work by comparing past performance. It is then possible to automate the strategy instead of guessing and possibly losing money.

Automation Keeps You on Plan

Many traders begin with a plan for trading and then lose track of it after a while. A popular saying in the investment world is "plan the trade first, then trade according to the strategy." This is easier when you automatize your trades so that you can continuously execute your strategy to achieve profitable results over a specific time.

Helps You to Stay Diversified

The goal of trading is to maximize profits while minimizing risks, and trading with algos will help traders reach this aim faster and more reliable than manual or analog tools. Computer-controlled systems let you trade multiple strategies and accounts simultaneously and find opportunities to make money and lose it with rapid market scans.

Disadvantages

Mechanical Problems

Automated trading appears easy to set up the software to program the rules and let it trade. In reality, it is an advanced technique of trading; however not a guarantee. According to the trading platform, the order for trading could be on a computer rather than an actual server. That means if the internet connection fails and an order cannot be available in the marketplace. It could also result in an inconsistency between the "theoretical trading strategies" produced by this algorithm and the order entry component of the platform, which converts them into actual trades. Most traders expect to experience a learning curve when working with automated trading platforms, and it's generally advised to begin with small trading sizes until the system is perfected.

Monitoring

While it is nice to switch on your computer and go to sleep for the day, automated trading systems require constant monitoring. This is because of mechanical issues that could result from connectivity issues, power loss, and computer crash, in addition, due to system glitches. There is a possibility that an automated system could encounter abnormalities that may result in incorrect orders, lost orders, and duplicate transactions. If the trading system can be monitored, such incidents can be detected and addressed promptly.

Over-optimization

While not limited to automated trading techniques, traders who use backtesting methods can design designs that look amazing on paper but perform poorly in live markets. Over-optimization is the term used to describe excessive curve-fitting that results in a trading plan that is not reliable when trading lives. There is a way to alter strategies to produce extraordinary results based on the historical data that was evaluated. Many traders believe that a plan for trading must contain close to 100% successful trades or not have a drawdown to be considered a viable strategy.