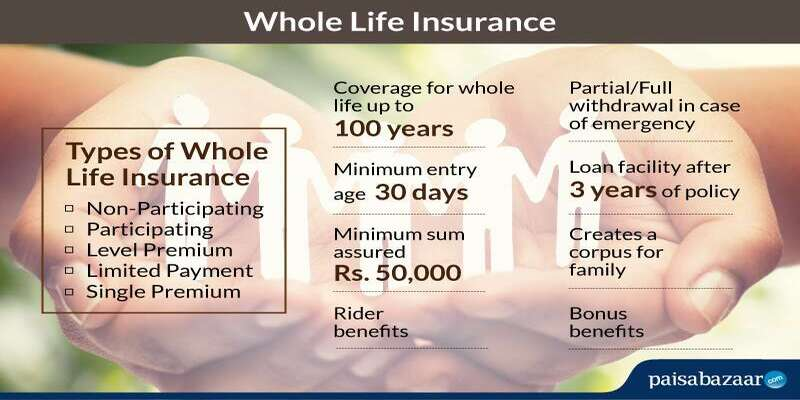

As long as the premiums are kept current, the policyholder is protected by their whole life insurance policy. Unlike whole life insurance guide with a term, which only covers a policyholder for a specified time frame, whole life insurance policies remain in effect until they expire or are canceled. The death benefit is the amount of money owed to the policyholder's beneficiaries after the policyholder's death. A life insurance policy's cash value acts like an investment that can be borrowed from or withdrawn tax-free for the policyholder's lifetime. Because of the permanent coverage and investment component, whole life insurance rates are often higher than term life insurance premiums. In contrast to term life insurance, whole life insurance has premiums that don't change over the policy's duration.

What Is Whole Life Insurance?

The insured under a whole-life policy remains protected for the duration of the policy. In most cases, the beneficiaries of a whole life insurance policy will receive a certain sum of money following the insured's death. Cash value is accumulated in a whole life insurance policy over time in addition to the death payout. This monetary value may be relinquished for its cash value, used as collateral for loans, or borrowed against to pay premiums.

How Does Whole Life Insurance Work?

The premium is the monthly payment made to the guide to selling whole life insurance by the policyholder in exchange for the protection provided by the policy. In return, they'll pay your beneficiaries out in the event of your untimely demise and cover you for life. The insurance's cash value grows while the premium helps cover the cost of the death benefit. The cash value of your coverage increases as you continue to pay your premiums. The insurance business puts the money it receives in policies' premiums into various assets, including bonds and equities. The cash value of the insurance rises over time, free from taxation. A whole life insurance policy's cash value has various applications. In other words, you may use the policy's cash value as collateral to get a loan.

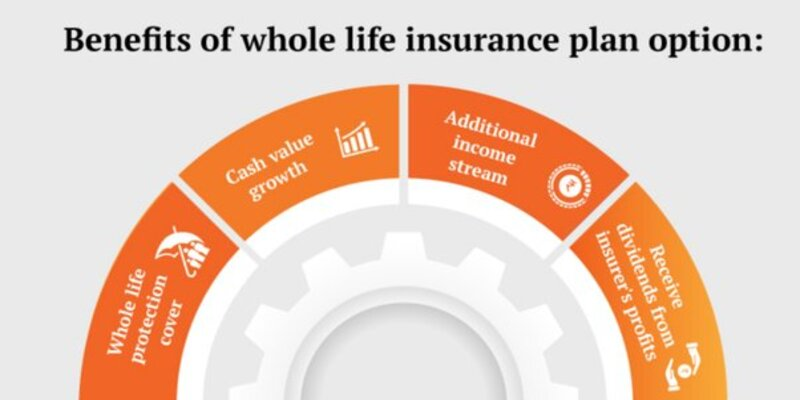

Advantages Of Whole Life Insurance

Among the many benefits of whole life insurance are the following:

- As long as the premiums are kept current, the insured under a whole-life policy is protected for the rest of their lives. Because of this provision, the policyholder's beneficiaries are guaranteed a death benefit upon the policyholder's death.

- The beneficiaries of a whole life insurance policy will receive a certain sum of money upon the insured's death, and this payment is guaranteed. The policyholder may rest easy knowing that their loved ones will be provided for financially after their passing.

- The cash value of a guide to whole life insurance policy grows over time and may be borrowed against or cashed in if the policyholder chooses to do so. As a result, the policyholder receives an additional savings component.

- To rephrase: a whole life insurance policy's cash value grows tax-free until the policyholder withdraws the money from the policy. Most beneficiaries also won't have to shell out a lot in taxes to receive the payout.

- Whole life insurance may be an important part of your estate strategy. The cash value and death benefit might cover estate taxes and other last expenses.

Who May Benefit From Purchasing Entire Life Insurance?

For some people, whole life insurance makes sense.

- Whole life insurance may provide you peace of mind if you require coverage for the rest of your life, for example, to care for a kid with special needs.

- Savings Accumulation Whole life insurance has a savings component that may be borrowed against or surrendered for its cash value if the policyholder chooses to do so.

- Plan your estate using life insurance: Since the death benefit may be used to pay estate taxes and the cash value can be utilized to give liquidity to the estate, whole life insurance is a useful instrument for estate planning.

- The high cost of estate taxes could be avoided by purchasing whole life insurance if you have a big estate.

- If you want the security of a set premium and death benefit and have a low tolerance for risk, whole life insurance may be a smart choice.

Conclusion

Those needing permanent protection and who want to save money over time may find whole-life insurance attractive. It has possible tax benefits, a guaranteed death payout, and a cash value buildup. Higher premiums and fewer investment choices mean it's not the ideal choice for everyone. Before committing to a whole life insurance policy, one must thoroughly assess one's wants and means.